Superannuation Investment Option

Salaam Balanced

An investment option for members seeking the ability to balance income and long term capital growth.

| Description |

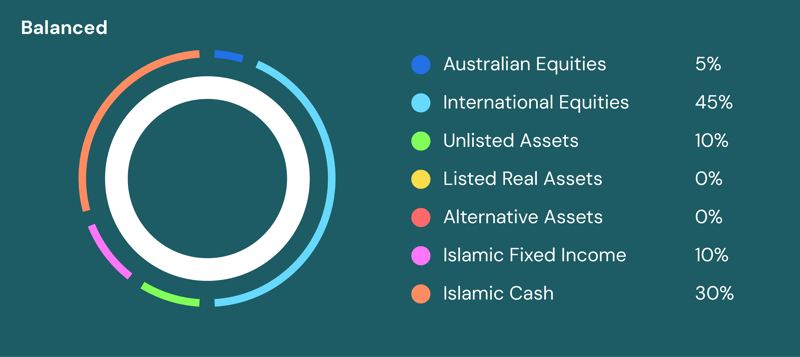

Invests across a diversified range of Islamic assets, including Australian and International Equities, Unlisted Assets, Islamic Cash and Islamic Fixed Income. This option is intended for members seeking an investment option with a balance of income and capital growth, with the emphasis on long-term capital growth. |

| Investment objective |

To achieve an average net return (after costs and tax) equal to or better than inflation plus 2.5% p.a. over rolling 7-year periods. |

| Suggested minimum timeframe | Minimum 7 years |

| Target allocation 1 | 60%-80% Growth Assets 20%-40% Defensive Assets |

| Long term risk level | Low |

| Administrative fees and costs | 0.23% of your account balance per year plus $60 per year |

| Investment fees & costs (estimates only) 2 | 1.36% of assets p.a. |

| Transaction costs (estimates only) | 0.03% of assets p.a. |

1 Target allocation is a strategic benchmark only. Actual allocations may vary within the described ranges.

2 Investment fees and costs shown here are forward-looking estimates applicable from the date of preparation of this PDS and do not include performance fees as performance fees are not applicable. Refer to the ‘Additional Explanation of Fees and Costs’ in the Salaam superannuation Investment Guide.